Please note, we have recently updated our Privacy Policy

Leaders in Corporate and Trust Services

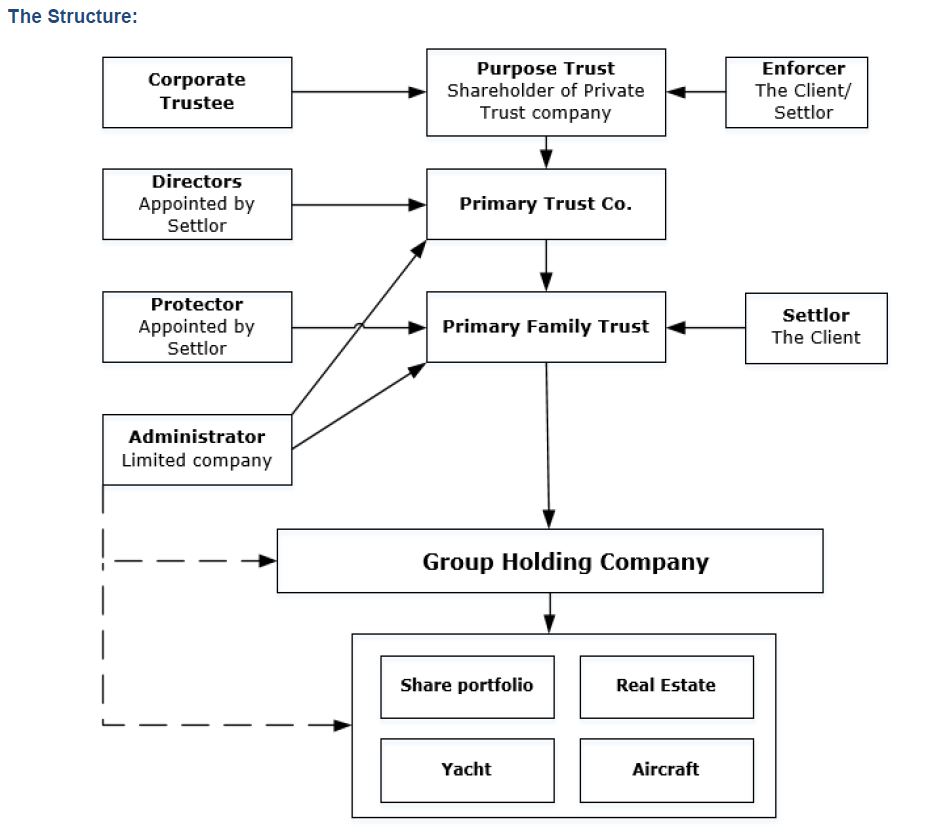

The Private Trust Company (“PTC”)

The Private Trust Company allows for trusted advisors to manage assets on behalf of their clients.

How a PTC works:

- The PTC is a company that is specifically formed to act as trustee for a family trust(s) and can be owned by the Settlor, family members or more frequently by a specific Purpose Trust, which is a trust with no beneficiaries and must operate for non-commercial purposes.

- It is crucial that management and control of the trust company and its assets is undertaken from outside the clients’ home jurisdiction. For this reason professional directors resident in the Isle of Man will be appointed to the Private Trust Company.

- The level of control permitted usually depends upon the domestic tax regulations to which the client is subject.

- Often the head of the family can act as a ‘Protector’ to the Trust, in which case they will have the power to effectively block distributions to its beneficiaries.

- The enforcer (whose role is comparable to that of a trust protector) must be an independent person to the trustees and is required to ensure that the trustees carry out the objects of the purpose trust. To do so the enforcer has an absolute right of access to any information or documentation which relates to the trust, including the assets of the trust and the records in respect of its administration.

- It is usual for the settlor not to have any ownership in the PTC

- An Isle of Man purpose trust cannot be used to hold any interest directly or indirectly in land in the Isle of Man

Some of the advantages of a PTC:

- Provides flexibility to the family and the dealings of its assets, which would normally be more complicated if settled within a usual Trust structure.

- Wealth protection and allows for succession planning via the ability to introduce younger members to the running of the family office

- The Settlor and/or family have greater control of the assets than that of a normal trust structure,

- Recognised in all common law jurisdictions

- Allows for assets to be held for a purpose rather conferring a specific benefit on any person

- Most types of assets can be held by the PTC

- An important tool in international income, capital gains and estate tax planning

- May need to be licensed if it receives income, but an exemption can be applied for

- A primary advantage is that there are no registration or disclosure requirements under IoM Law

- To hold an investment where it is desirable to avoid consolidation issues where a controlling interest is held in the investment entity.

Our Services:

Trust services, including the establishment and administration of special purpose trusts, can be delivered by the relationship management team based in the Isle of Man and Malta. We have experience in establishing all forms of trusts including private trust companies. Our services include:

- Providing family office service

- Acting as trustee, executor, trust administrator, protector, enforcer, nominee or escrow agent

- Incorporating, and administering underlying offshore companies

- Maintaining trustee statutory records

- Assisting with asset protection, tax/financial planning and succession planning

- "Real Time" management, financial and statutory accounting and tax reporting

We appoint a relationship manager to our clients dependent on their experience and expertise so we ensure all our clients get the best possible service from the most appropriate member of the senior management team. All the above services can be delivered through a range of domiciles.

For further information on any of the above services, please contact:

David Solly